| | | | ☐ | | Preliminary Proxy Statement | | | ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | | | ☒ | | Definitive Proxy Statement | | | ☐ | | Definitive Additional Materials | | | ☐ | | Soliciting Material under § 240.14a-12 |

STANDEX INTERNATIONAL CORPORATION (Name of Registrant as Specified In Its Charter) (Name of Person(s) Filing Proxy Statement, if other than the Registrant) Payment of Filing Fee (Check the appropriate box): | | | | | | | ☒ | | No fee required. | | | ☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | | | | | | (1) | | Title of each class of securities to which transaction applies:

| | | (2) | ☐ | Aggregate number of securities to which transaction applies:

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| | | (4) | | Proposed maximum aggregate value of transaction:

| | | (5) | | Total fee paid:

| | | ☐ | | Fee paid previously with preliminary materials. | | | ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | | | | | | (1) | | Amount Previously Paid:

| | | (2) | ☐ | Form, Schedule or Registration Statement No.:Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14-6(i)(1) and 0-11.

|

Guide to Standex’s Proxy Statement Invitation to 2023 Annual Meeting of Shareholders | 3 | | | (3) | Notice of Annual Meeting of Shareholders | Filing Party:4

| | | (4) | | Date Filed:

|

GUIDETO STANDEX’S PROXY STATEMENT

INVITATIONTO 2021 ANNUAL MEETINGOF SHAREHOLDERSInvitation to 2023 Annual Meeting of Shareholders

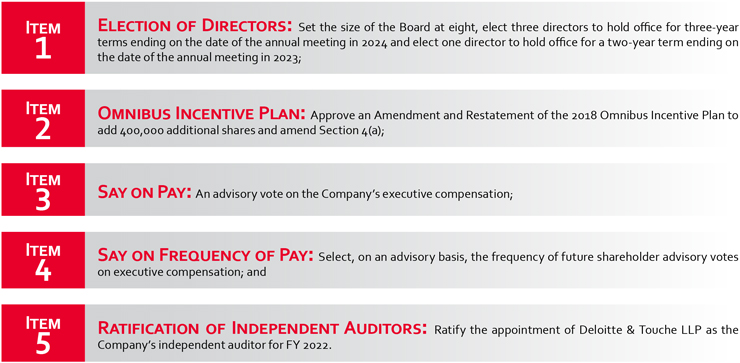

Tuesday, October 26, 202124, 2023 9:00 a.m., local time Standex International Corporation Corporate Headquarters 23 Keewaydin Drive, Suite 300, Salem, New Hampshire 03079*03079 Dear Shareholder, We cordially invite you to attend Standex’s Annual Meeting of Shareholders. We hope that you will join me, our Board of Directors, and other shareholders at the meeting. The attached Notice of Annual Meeting of Shareholders and Proxy Statement contain information about the business that will be conducted at the meeting. Following the meeting, I will present information on Standex’s operations and welcome any questions from shareholders. Your vote is important to us! If you plan on attending the meeting, you may vote your shares in person. If you cannot vote in person, we urge you to vote via your proxy card, over the phone or on the Internet prior to the meeting. Detailed instructions on how to vote are found onpage 7369. Thank you in advance for voting your shares, and thank you for your continued support of Standex. Sincerely, | | |

David Dunbar President/CEO Chair, Board of Directors | |

Standing from left to right: Jeffrey S. Edwards, Michael A. Hickey, Robin J. Davenport, (nominee for election to the Board), Charles H. Cannon, Jr., David Dunbar, and Thomas E. Chorman. Seated from left to right:B. Joanne Edwards and Thomas J. Hansen. |

* | Our Annual Meeting will follow all COVID-19 public health protocols, including keeping attendees at social distance and requiring all attendees to wear face coverings, which will be provided. In the unlikely event that we are not able to hold the Annual Meeting in person, we will notify all shareholders, through a press release and at www.envisionreports.com/sxi, regarding an alternative location or remote access.

|

NOTICEOF ANNUAL MEETINGOFNotice of Annual Meeting of

SHAREHOLDERSShareholders

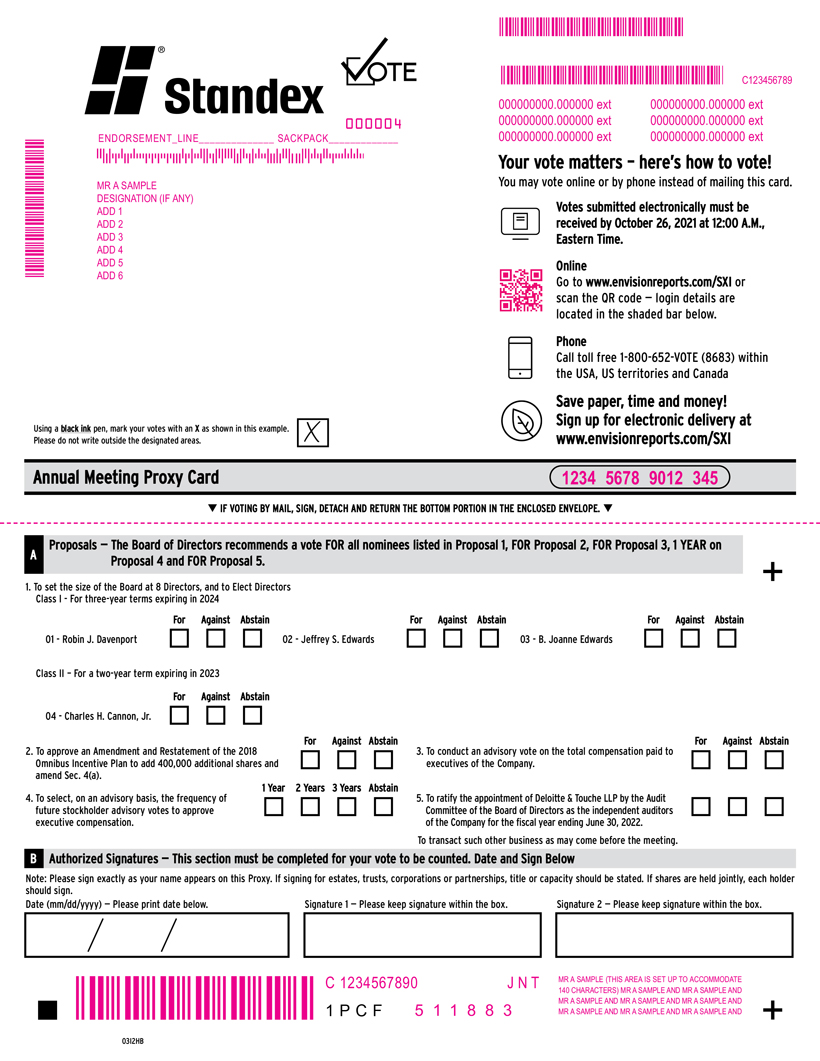

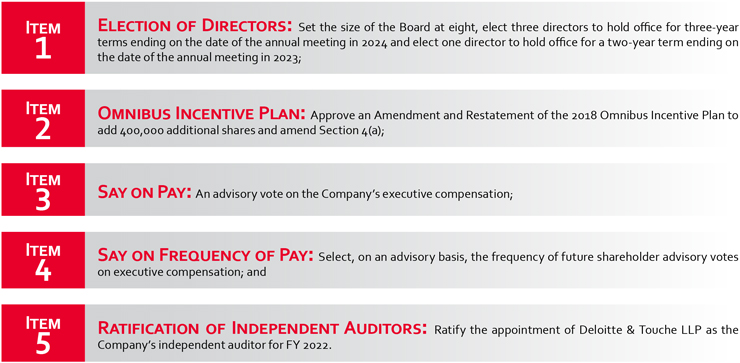

The 20212023 Annual Meeting of Shareholders (the “Annual Meeting”) of Standex International Corporation (the “Company” or “Standex”) will be held on Tuesday, October 26, 202124, 2023 at 9:00 a.m., local time, at the Company’s Corporate Headquarters, located at 23 Keewaydin Drive, Suite 300, Salem, New Hampshire 03079.* You are receiving these proxy materials in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Standex, a Delaware corporation, to be voted at the 20212023 Annual Meeting and any continuation, adjournment or postponement thereof. Shareholders of record at the close of business on August 31, 20212023 are entitled to vote at the meeting, either in person or by proxy, on the following matters, as well as the transaction of any other business properly presented at the Annual Meeting:

On September 10, 2021, we began to mail our shareholders either a notice containing instructions on how to access this Proxy Statement and our Annual Report through the Internet, or a printed copy of these materials. We have provided each shareholder with a Notice of Internet Availability of Proxy Materials (the “Notice”), which encourages shareholders to review all proxy materials and our annual report and vote online at www.envisionreports.com/sxi. We believe that reviewing materials online reduces our costs, eliminates surplus printed materials and generally reduces the environmental impact of our Annual Meeting. If you would like to receive a printed copy of our proxy materials, please follow the instructions contained in the Notice.

All proxy solicitation costs are paid by the Company. In addition to proxy solicitations made by mail, the Company’s directors and officers may solicit proxies in person or by telephone.

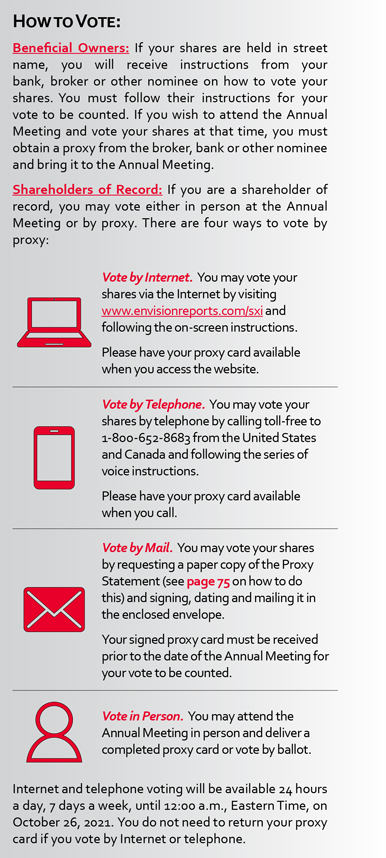

Your vote is important. Whether or not you plan to attend the Annual Meeting, we hope that you will vote your shares as soon as possible. We encourage you to vote via the Internet, since it is convenient and significantly reduces postage and processing costs. You may also vote via telephone or by mail if you received paper copies of the proxy materials. Instructions regarding the methods of voting are included in the Notice, the proxy card and this Proxy Statement on page 73.

By Order of the Board of Directors,

Alan J. Glass, Secretary

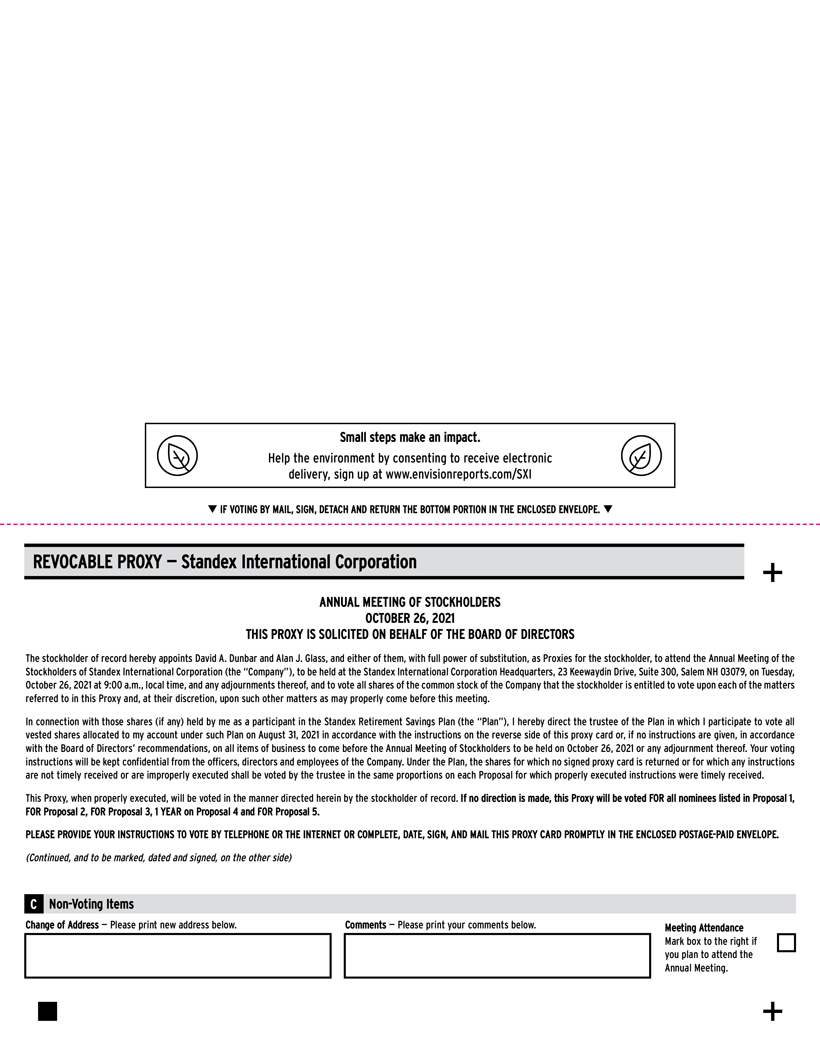

Item 1 | | Election of Directors: Elect three directors to hold office for three-year terms ending on the date of the annual meeting in 2026; | | | | Item 2 | Say on Pay: An advisory vote on the Company’s executive compensation; | | | Item 3 | Ratification of Independent Auditors: Ratify the appointment of Deloitte & Touche LLP as the Company’s independent auditors for FY 2024. |

On September 8, 2023, we began to mail our shareholders either a notice containing instructions on how to access this Proxy Statement and our Annual Report through the Internet, or a printed copy of these materials. We have provided each shareholder with a Notice of Internet Availability of Proxy Materials (the “Notice”), which encourages shareholders to review all proxy materials and our annual report and vote online at www.envisionreports.com/sxi. We believe that reviewing materials online reduces our costs, eliminates surplus printed materials and generally reduces the environmental impact of our Annual Meeting. If you would like to receive a printed copy of our proxy materials, please follow the instructions contained in the Notice. All proxy solicitation costs are paid by the Company. In addition to proxy solicitations made by mail, the Company’s directors and officers may solicit proxies in person or by telephone. | Your vote is important. Whether or not you plan to attend the Annual Meeting, we hope that you will vote your shares as soon as possible. We encourage you to vote via the Internet, since it is convenient and significantly reduces postage and processing costs. You may also vote via telephone or by mail if you received paper copies of the proxy materials. Instructions regarding the methods of voting are included in the Notice, the proxy card and this Proxy Statement on page 69. By Order of the Board of Directors,

Alan Glass, Secretary |

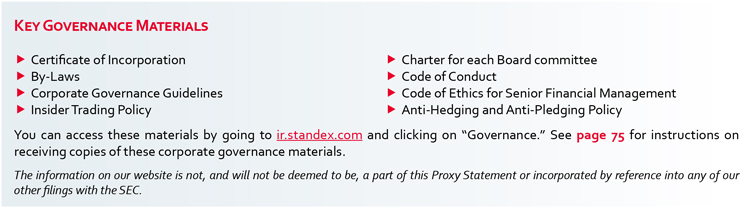

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON OCTOBER 26, 2021.24, 2023 | | As permitted by the SEC, the 20212023 Notice of Annual Meeting of Shareholders and Proxy Statement and the 20212023 Annual Report on Form 10-K are available for review at ir.standex.com by clicking “Financials” and then “Annual Reports.” |

* | Our Annual Meeting will follow all COVID-19 public health protocols, including keeping attendees at social distance and requiring all attendees to wear face coverings, which will be provided. In the unlikely event that we are not able to hold the Annual Meeting in person, we will notify all shareholders, through a press release and at www.envisionreports.com/sxi, regarding an alternative location or remote access.

|

PROXY STATEMENT SUMMARYProxy Statement Summary

This summary contains a general overview of this Proxy Statement. It highlights information contained elsewhere in this Proxy Statement and is meant to be used as a quick reference. This summary does NOT contain all of the information that you should consider before voting. You should read the entire Proxy Statement carefully before voting. | | | 2021 ANNUAL MEETING2023 Annual Meeting | | |

You are receiving these proxy materials in connection with the solicitation of proxies by the Board of Directors of Standex International Corporation, a Delaware corporation, to be voted at the 20212023 Annual Meeting and any continuation, adjournment or postponement thereof. On September 10, 2021,8, 2023, we began to mail our shareholders either a notice containing instructions on how to access this Proxy Statement and our Annual Report through the Internet, or a printed copy of these materials. The Notice explains how you may access and review the proxy materials and how you may submit your proxy via the Internet. If you would like to receive a printed copy of our proxy materials, please follow the instructions contained in the Notice. All proxy solicitation costs are paid by the Company. In addition to proxy solicitations made by mail, the Company’s directors and officers may solicit proxies in person or by telephone. | | | AGENDAAND VOTING RECOMMENDATIONSAgenda and Voting Recommendations | | |

| | | | | Item | | Proposals | | Board Vote Recommendation | 1 | | Election of Directors | | FOR | 2 | | Amended and Restated Omnibus Incentive Plan

| | FOR

| 3

| | Advisory Vote on Executive Compensation | | FOR | 43

| | Advisory Vote on Frequency of Say on Pay

| | FOR “One Year”

| 5

| | Ratification of Auditors | | FOR |

| Vote by Internet.

Visit www.envisionreports.com/sxi. |  | | Vote by Mail. Complete, sign, date and return your proxy card by mail. | 6 | Vote by Telephone.

Call toll-free to 1-800-652-VOTE (8683). | 2021 PROXY STATEMENT | | Vote in Person. You may attend the Annual Meeting in person and deliver a completed proxy card or vote by ballot. |

Internet and telephone voting will be available 24 hours a day, 7 days a week, until 1:00 a.m., Eastern Time, on October 24, 2023. You do not need to return your proxy card if you vote by Internet or telephone.

Item 1 BOARD NOMINEESElectionofDirectors

The Board and the Nominating and Corporate Governance Committee believe that the three director nominees possess the necessary qualifications and experiences to provide advice to the Company’s management and effectively oversee the business and the long-term interests of shareholders. We are asking shareholders to vote to elect three director nominees to hold office until the 2026 annual meeting and until their successors have been elected and qualified. Please see page 9for more information. Our Board recommends a vote FORthis Item. |

Board Nominees & CONTINUING DIRECTORSContinuing Directors | | |

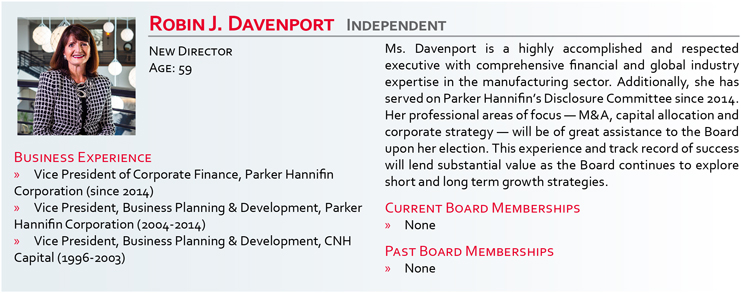

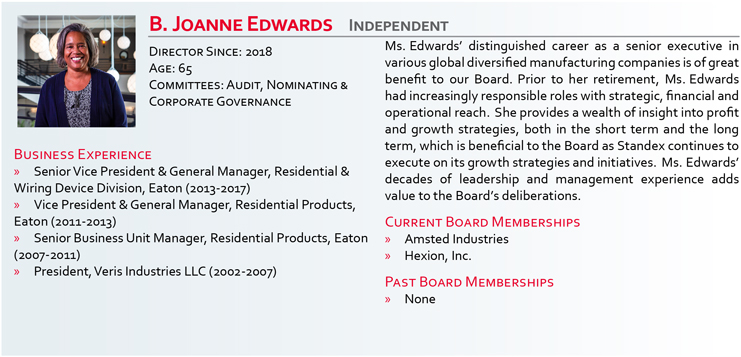

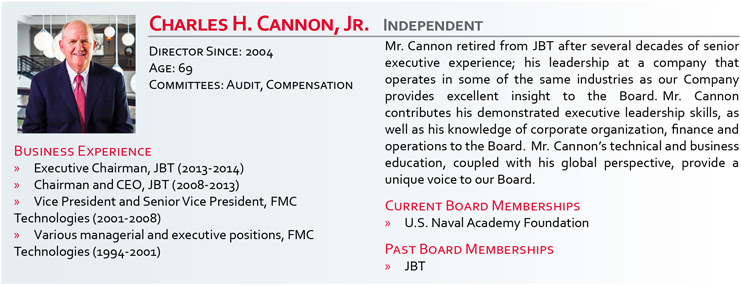

| | | | | | | | | | | | | | | | Age | | Years of Tenure | | Term Expiration | | Committee Memberships | | Name | | A | | C | | N&CG | | | | | | | | ROBIN J. DAVENPORT* INDEPENDENT Vice President of Corporate Finance, Parker Hannifin Corporation | | 59 | | 0 | | - | |  | |  | |  | | | | | | | | JEFFREY S. EDWARDS** INDEPENDENT Chairman and Chief Executive Officer, Cooper Standard Holdings, Inc. | | 59 | | 7 | | 2021 | |  | |  | |  | | | | | | | | B. JOANNE EDWARDS** INDEPENDENT Former Senior Vice President and General Manager, Eaton Corporation Plc. | | 65 | | 3 | | 2021 | |  | |  | |  | | | | | | | | CHARLES H. CANNON, JR. INDEPENDENT Former Executive Chairman and Chief Executive Officer, John Bean Technologies | | 69 | | 17 | | 2021 | |  | |  | |  | | | | | | | | THOMAS E. CHORMAN INDEPENDENT Chief Executive Officer, Solar LED Innovations, LLC | | 67 | | 17 | | 2022 | |  | |  | |  | | | | | | | | THOMAS J. HANSEN LEAD INDEPENDENT DIRECTOR Former Executive Vice Chairman, Illinois Tool Works, Inc. | | 72 | | 8 | | 2022 | |  | |  | |  | | | | | | | | DAVID DUNBAR President and Chief Executive Officer, Standex International Corporation | | 59 | | 7 | | 2023 | |  | |  | |  | | | | | | | | MICHAEL A. HICKEY INDEPENDENT Former Executive Vice President and President of Global Institutional, Ecolab, Inc. | | 60 | | 4 | | 2023 | |  | |  | |  |

| | | | | | | | | | | | | | Years of | Term | Committee Memberships | | Name | Age | Tenure | Expiration | A | C | N&CG | I&T | Charles H. Cannon, Jr. Independent Former Executive Chairman and Chief Executive Officer, JBT Corporation | 71 | 19 | 2023 | | |  |  | David Dunbar President and Chief Executive Officer, Standex International Corporation | 62 | 9 | 2023 |  |  |  |  | Michael A. Hickey Independent Former Executive Vice President and President of Global Institutional, Ecolab, Inc. | 62 | 6 | 2023 |  |  |  |  | Robin J. Davenport Independent Former Vice President of Corporate Finance, Parker Hannifin Corporation | 61 | 2 | 2024 |  |  |  |  | Jeffrey S. Edwards* Independent Chairman and Chief Executive Officer, Cooper Standard Holdings, Inc. | 61 | 9 | 2024 |  |  |  |  | B. Joanne Edwards* Independent Former Senior Vice President and General Manager, Eaton Corporation Plc. | 67 | 5 | 2024 |  |  |  |  | Thomas E. Chorman Independent Chief Executive Officer, Solar LED Innovations, LLC | 69 | 19 | 2025 |  |  |  | | Thomas J. Hansen Lead Independent Director Former Executive Vice Chairman, Illinois Tool Works, Inc. | 74 | 10 | 2025 |  |  |  |  |

* Jeffrey S. Edwards and B. Joanne Edwards are not related. | | A Audit Committee N&CG Nominating & Corporate Governance Committee | C Compensation Committee | | N&CGI&T NominatingInnovation & Corporate

GovernanceTechnology Committee

| |   Chair Chair

Member Member

| | | * New nominee for Director.

** Jeffrey S. Edwards and B. Joanne Edwards are not related.

|

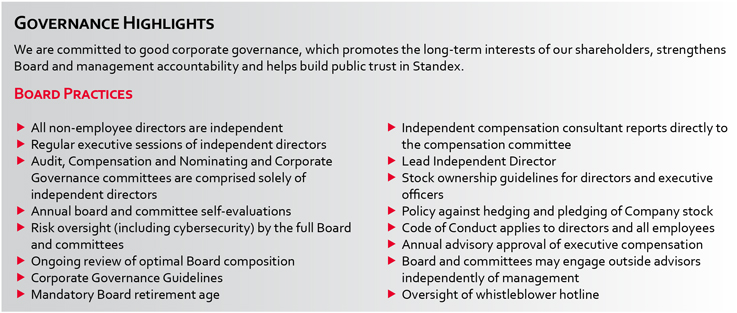

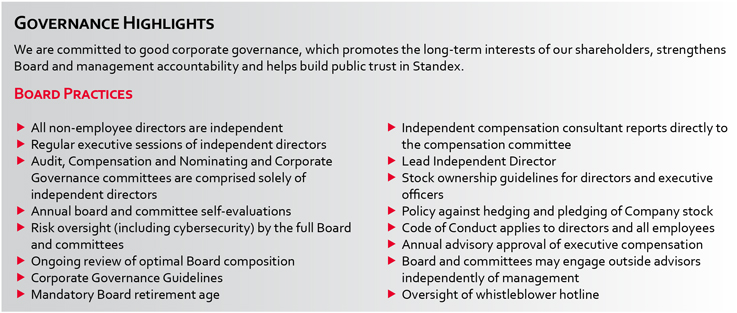

| | | CORPORATE GOVERNANCE HIGHLIGHTSCorporate Governance Highlights | | |

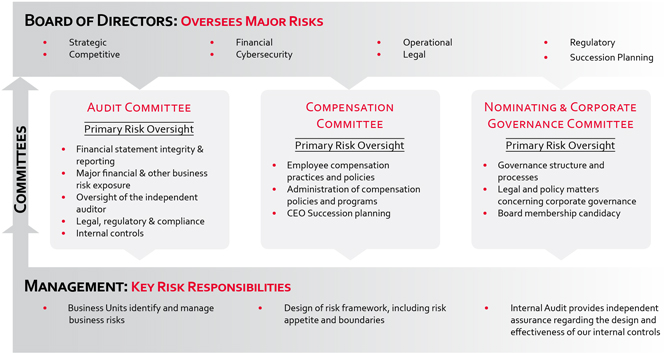

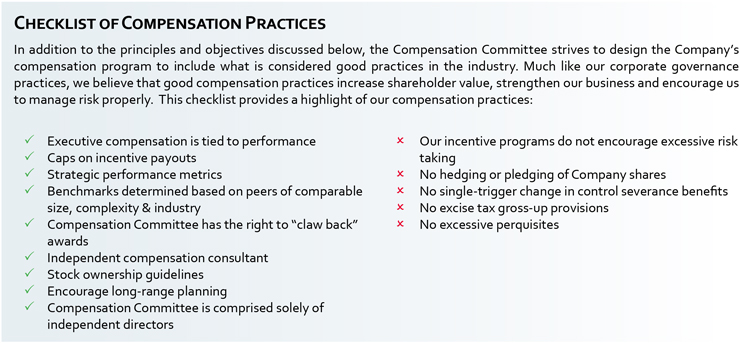

We are committed to strong corporate governance practices, which promote the long-term interests of shareholders, strengthen financial integrity and hold our Board and management accountable. The highlights of our corporate governance practices include the following: | • | All non-employee directors are independent | | • | Regular executive sessions of independent directors | | • | All Board committees are comprised solely of independent directors | | • | Annual board and committee self-evaluations | | • | Risk oversight (including cybersecurity) by the full Board and committees | | • | Ongoing review of optimal Board composition | | • | Independent compensation consultant reports directly to the Compensation Committee | | • | Lead Independent Director | | • | Corporate Governance Guidelines | | • | Stock ownership guidelines for directors and executive officers |

Regular executive sessions of independent directors

Audit, Compensation and Nominating and Corporate Governance committees are comprised solely of independent directors

Annual board and committee self-evaluations

Risk oversight (including cybersecurity) by the full board and committees

Ongoing review of optimal Board composition

Independent compensation consultant reports directly to the Compensation Committee

Lead Independent Director

Corporate Governance Guidelines

Stock ownership guidelines for directors and executive officers

Policy against hedging and pledging of Company stock

Code of Conduct applies to directors & all employees

Annual advisory approval of executive compensation

Board and committees may engage outside advisors independently of management

Oversight of whistleblower hotline

Mandatory Board retirement age

| • | Policy against hedging and pledging of Company stock | | • | SEC compliant clawback policy has been adopted | | • | Code of Conduct applies to directors & all employees | | • | Annual advisory approval of executive compensation | | • | Board and committees may engage outside advisors independently of management | | • | Oversight of whistleblower hotline | | • | Mandatory Board retirement age | | • | Periodic committee chair and membership rotations | | • | Oversight of ESG strategy and reporting |

Item 2 2021 PROXY STATEMENTAdvisory

VoteonExecutiveCompensationWe are asking shareholders to vote on an advisory basis on the compensation paid to our Named Executive Officers as described in the Compensation Discussion and Analysis beginning on page 36 and the Compensation Tables beginning on page 54. Please see page 14for more information. Our Board recommends a vote FORthis Item. |

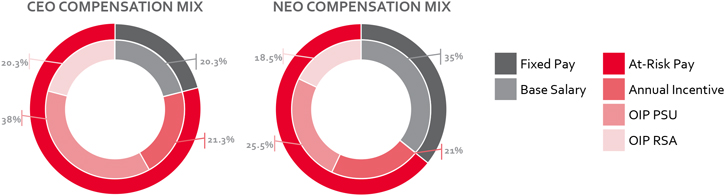

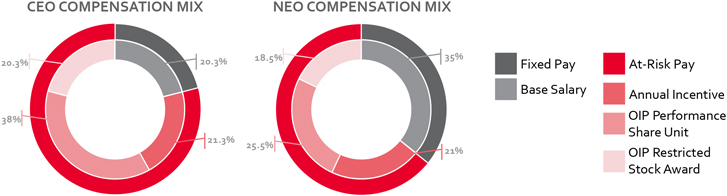

| At-Risk Compensation Mix | | | 7 | |

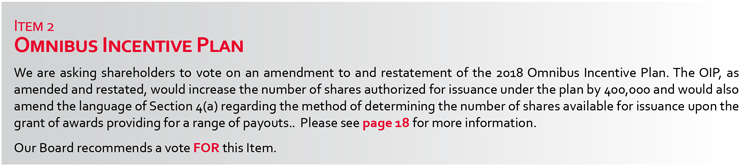

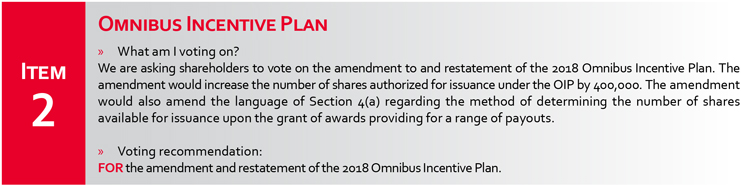

On October 23, 2018, our shareholders approved the 2018 Omnibus Incentive Plan. Under the OIP, as approved, there were 500,000 shares authorized for issuance. At the time of the approval, we believed this amount would be sufficient for award grants for the next 5 fiscal years. We have revised our estimates and we now believe there are sufficient shares available for anticipated FY 2022 grants, but there may not be sufficient shares available for FY 2023 grants. For this reason, the Board has approved and recommends an amendment to and restatement of the OIP to increase the number of shares authorized for issuance under the plan by 400,000. The Board also has approved and recommended an amendment to Section 4(a) of the OIP regarding the method of determining the number of shares available for issuance under the OIP. This amended and restated OIP would require that for every share granted under an award under the OIP, the number of total shares available for issuance be reduced by 1.0. Approval of this amendment and restatement will increase the number of currently available shares to over 600,000 and we believe this will be sufficient for anticipated grants through the next 5 fiscal years.

Please refer to page 18 for the full proposal and the plan summary. Please refer to Appendix A, starting on page 78 for the full text of the OIP, as amended and restated.

Below is some key information regarding grant practices, burn rate, dilution and overhang.

| | | | | | | | | | | | | | Equity Metric | | 2021 | | | 2020 | | | 2019 1 | | | | | | Percentage of equity awards granted to NEOs | | | 52 | % | | | 51 | % | | | 0 | % | | | | | Equity burn rate 2 | | | 1.29 | % | | | 0.98 | % | | | 0.11 | % | | | | | Dilution 3 | | | 3.87 | % | | | 5.09 | % | | | 5.82 | % | | | | | Overhang 4 | | | 2.81 | % | | | 2.11 | % | | | 1.88 | % |

| Named Executive Officer | | Actual Salary ($) | | | Stock Awards ($) | | | Non-Equity

Incentive Plan Compensation

($) | | | All Other Compensation ($) | | | Total

($) | | David Dunbar

President & CEO | | | 892,597 | | | | 3,405,266 | | | | 471,302 | | | | 164,853 | | | | 5,098,597 | | Ademir Sarcevic Vice President, CFO & Treasurer | | | 465,330 | | | | 799,455 | | | | 255,564 | | | | 46,848 | | | | 1,570,539 | | Alan Glass

Vice President, CLO & Secretary | | | 388,967 | | | | 536,910 | | | | 96,789 | | | | 52,462 | | | | 1,082,635 | | Annemarie Bell Chief Human Resources Officer | | | 311,512 | | | | 225,923 | | | | 177,054 | | | | 19,689 | | | | 734,304 | | Sean Valashinas

Chief Accounting Officer & Assistant Treasurer | | | 275,783 | | | | 154,791 | | | | 68,018 | | | | 18,140 | | | | 516,731 | | Paul Burns Former Vice President, Business Development & Strategy | | | 285,088 | | | | 392,302 | | | | - | | | | 24,155 | | | | 881,233 | | Flavio Maschera Former Chief Innovation & Technology Officer | | | 292,824 | | | | 245,835 | | | | - | | | | 1,312,086 | | | | 1,850,745 | |

| | 1 | FY 2019 grants made prior to the October 23, 2018 adoption of the OIP were made under the 2008 Long Term Incentive Plan. The values contained here include FY 2019 grants made under the OIP only.Note:

|

| 2 | The burn rate is calculated by taking the number of shares granted and dividing that by the weighted average basic Common Stock outstanding. The following table provides information regarding stock-settled, time-vested equity awards granted and performance-based, stock-settled equity awards granted over each of the last 3 fiscal years:

|

| | | | | | | | | | | | | | | | 2021 | | | 2020 | | | 2019 | | | | | | Time-Vested Restricted Shares/Units Granted | | | 72,475 | | | | 75,505 | | | | 16,273 | | | | | | MSPP Shares Granted | | | 19,311 | | | | 14,883 | | | | - | | | | | | Performance-Based Stock Units Granted (at target) | | | 69,071 | | | | 42,976 | | | | - | | | | | | Weighted Average Basic Common Stock Outstanding | | | 12,156,000 | | | | 12,324,000 | | | | 12,574,000 | |

| 3 | The dilution is calculated by taking the sum of (i) the number of shares granted and outstanding under awards at fiscal year end and (ii) the number of shares available for issuance under the OIP at fiscal year end, and dividing that sum by the number of outstanding Common Stock at fiscal year end.

|

| 4 | The overhang is calculated by taking the number of shares granted and outstanding under awards at fiscal year end and dividing it by the number of outstanding Common Stock at fiscal year end.

|

| | | | | | | | | | | | | | | | | | | | | | Named Executive Officer | | Actual Salary

($) | | | Stock Awards

($) | | | Non-Equity

Incentive Plan

Compensation

($) | | | All Other

Compensation

($) | | | Total ($) 1 | | | | | | | | David Dunbar President & CEO | | | 864,870 | | | | 3,681,435 | | | | 772,961 | | | | 110,204 | | | | 5,784,732 | | | | | | | | Ademir Sarcevic Vice President, CFO & Treasurer | | | 433,675 | | | | 894,037 | | | | 396,649 | | | | 26,638 | | | | 1,751,948 | | | | | | | | Alan J. Glass Vice President, CLO & Secretary | | | 365,907 | | | | 675,728 | | | | 171,298 | | | | 33,680 | | | | 1,254,084 | | | | | | | | Paul C. Burns Vice President of Business Development & Strategy | | | 365,907 | | | | 413,611 | | | | 316,709 | | | | 28,732 | | | | 1,124,959 | | | | | | | | James Hooven Vice President of Operations & Supply Chain | | | 334,950 | | | | 189,251 | | | | 253,561 | | | | 15,840 | | | | 793,602 | |

| Note: | This table provides thecertain summary compensation information for FY 2021.2023. The Summary Compensation Table and associated footnotes may be found starting on page 6454. |

| 1 | As reported in The items here are from select columns of the Summary Compensation Table and not all items are shown here. The total is as reported in the Summary Compensation Table.

|

Item 3 RatificationofAppointmentofDeloitte&ToucheLLPasIndependent Auditors We are asking shareholders to ratify the selection of Deloitte & Touche LLP as the independent auditors of our consolidated financial statements and our internal controls over financial reporting for FY 2024. Please see page 15for more information. Our Board recommends a vote FORthis Item. |

| Audit | | 2021 PROXY STATEMENT | | | 9 | |

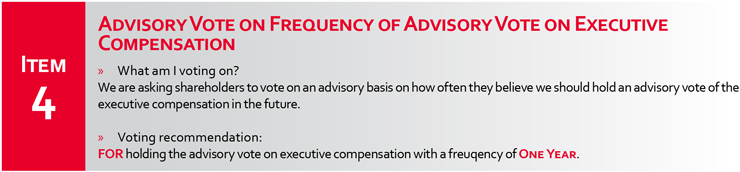

As required by the Dodd-Frank Wall Street Reform and Consumer Protection Act, every six years, the Board provides shareholders with the opportunity to cast an advisory vote on the frequency of the advisory vote to approve our executive compensation. This year, we are seeking a non-binding determination from our shareholders as to how often the “Say on Pay” advisory vote should be held. Shareholders have the following frequency options to choose from: each year, every two years or every three years.

When this advisory vote was last held in 2015, shareholders indicated a preference to hold the advisory vote on executive compensation each year, and the Board continued this practice.

The Board continues to believe that an annual advisory Say on Pay vote is the most appropriate policy for our shareholders and the Company at this time. An annual advisory vote allows the Board to receive timely, ongoing feedback from our shareholders. This assists the Board in taking shareholder views into account when considering changes to the executive compensation program. Additionally, an annual advisory vote is currently the standard desired by many shareholders.

Although this vote is non-binding, the Board values the opinions of the Company’s shareholders and will consider the outcome of the vote when making future decisions on the frequency of our Say on Pay proposals.

The Audit Committee has approved Deloitte & Touche LLP (“Deloitte”) to serve as our independent registered public accounting firmauditors for the 20222024 fiscal year. Deloitte has served as the Company’s independent auditors since 2021. Prior to 2021, Grant Thornton, LLP (“Grant Thornton”) served as the Company’s independent auditor.August 26, 2020. During this time, there have been no disagreements between the Company and either Deloitte or Grant Thornton on any matter of accounting principles or practices, financial statement disclosures or auditing scope or procedure. Also, during this time, neither Deloitte’s report nor Grant Thornton’s reportreports on the Company’s financial statements containeddid not contain any adverse opinion or a disclaimer of opinion, nor was itwere they qualified or modified as to uncertainty, audit scope or accounting principles. The following are the aggregate audit and non-audit fees billed to Standex by Deloitte, the member firms of Deloitte Touche Tohmatsu, and their respective affiliates for FY 20212022 and the aggregate audit and non-audit fees billed in FY 2020 to Standex by Grant Thornton, who served as Standex’s independent auditors during that year.2023. A full explanation of the types of fees and Deloitte’s role is contained in “Ratification of Independent Auditors” starting on page 2715. | | Type of Fees | | 2020 ($)* | | | 2021 ($)* | | | FY 2022 ($)* | | FY 2023 ($)* | | | Audit Fees | | | 1,563,000 | | | | 1,371,000 | | | 1,422,000 | | | 1,542,000 | | | Audit-Related Fees | | | 239,000 | | | | - | | | - | | | 15,000 | | | Tax Fees | | | 21,000 | | | | 94,000 | | | 34,000 | | | 28,000 | | | All Other Fees | | | 1,000 | | | | - | | | 113,000 | | | 2,000 | | | Total Fees | | | 1,824,000 | | | | 1,465,000 | | | | 1,569,000 | | | | 1,587,000 | |

| | * | Amounts have been rounded to the nearest thousand. |

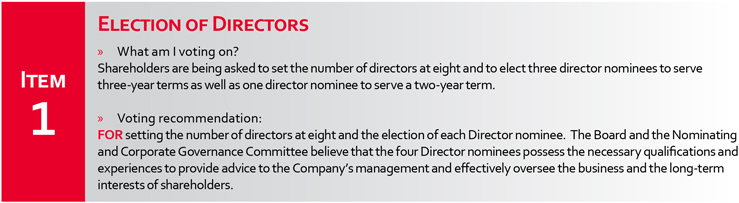

Please see “Questions & Answers” starting on page 69 for important information about these proxy materials, voting, the 2023 Annual Meeting, Company documents, communication with the Board and the deadlines to submit shareholder proposals and Director nominees for the 2024 annual meeting of shareholders. Item 1 | Election of Directors » What am I voting on? Shareholders are being asked to elect three director nominees to serve a three-year term. » Voting recommendation: FORthe election of each Director nominee. The Board and the Nominating and Corporate Governance Committee believe that the three Director nominees possess the necessary qualifications and experiences to provide advice to the nearest thousand.Company’s management and effectively oversee the business and the long-term interests of shareholders. |

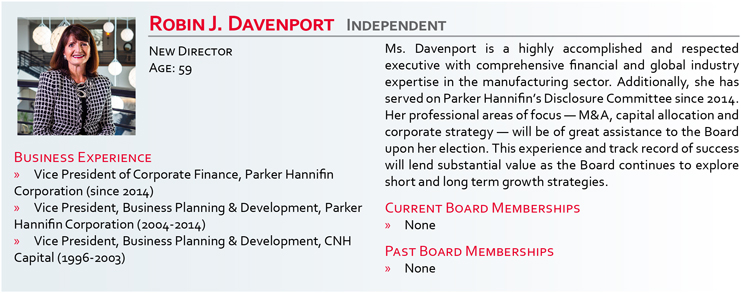

Our Board currently consists of seven directors; the election of Robin J. Davenport at the Annual Meeting would bring the board membership to eight. Prior to the 2020 annual meeting, the board had eight directors. At the 2020 annual meeting, Dr. Dan Hogan retired after 35 years of service. The Board had intended to recruit and nominate a successor to Dr. Hogan for election at the 2020 annual meeting. However, because of the challenges raised by the COVID-19 pandemic, the Board and Nominating & Corporate Governance Committee were unable to conduct a robust interview process in order to nominate a successor for election at the 2020 annual meeting. Over the past year, the Nominating & Corporate Governance Committee was able to engage in the recruitment process, and in April 2021, appointed Robin J. Davenport as a special advisor to the Board. She, along with the Class I directors, whose current terms are expiring, are being nominated for election to the Board. We have three classes of directors, with each class being as equal in size as possible. The term of each class is three years and class terms expire on a rolling basis, so that one class of directors is elected each year. The current Class I directors arethree director nominees, Charles H. Cannon, Jr., Jeffrey S. EdwardsDavid Dunbar and B. Joanne Edwards. WithMichael A. Hickey, are current Class II members of the addition of Ms. Davenport,Board. Their term is set to expire at the number of Class I2023 Annual Meeting. The Board believes that Mr. Cannon, Mr. Dunbar and Mr. Hickey possess the skills, abilities and experience to continue serving as directors would be four, leaving only twoand has nominated them to serve on the Board for an additional three-year term, to expire at the 2026 annual meeting. The Board recommends that shareholders elect Mr. Cannon, Mr. Dunbar and Mr. Hickey as Class II directors and two Class III directors (terms expiring at the 2023 and 2022 annual meetings, respectively). To keep the class size as equal as possible, as required by the NYSE listing standards, the Board has nominated Ms. Davenport, Mr. Edwards, and Ms. Edwards as Class I directors, with terms expiring at the 2024 annual meeting, and Mr. Cannon asfor a Class II director, with athree-year term expiring at the 2023 annual meeting. This will enable each Class to be balanced and allow for orderly election cycles. For the foregoing, the Board recommends that shareholders set the number of directors at eight, elect Ms. Davenport, Mr. Edwards, and Ms. Edwards as Class I directors for three-year terms, expiring at the 2024 annual meeting, and elect Mr. Cannon as a Class II director for a two-year term, expiring at the 20232026 annual meeting.

BOARDOF DIRECTORS MEMBERSHIP CRITERIA

| Board of Directors Membership Criteria |

The Board and the Nominating and Corporate Governance Committee believe that there are general qualifications that all directors must exhibit and other key qualifications and experiences that should be represented on the Board as a whole, but not necessarily by each individual director. QUALIFICATIONS REQUIREDOF ALL DIRECTORSQualifications Required of All Directors

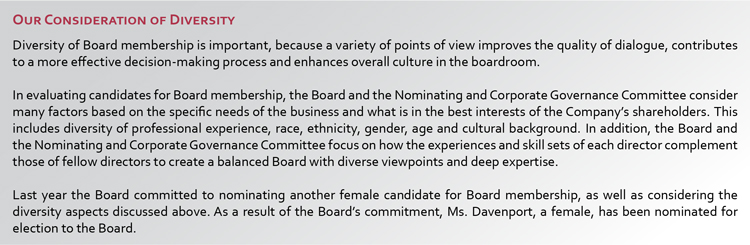

The Board and the Nominating and Corporate Governance Committee require that each director be a recognized person of high integrity with a proven record of success in his or her field, and be able to devote the time and effort necessary to fulfill his or her responsibilities to the Company. Each director must demonstrate innovative thinking, familiarity with and respect for corporate governance requirements and practices, an appreciation of multiple global cultures and a commitment to sustainability and to dealing responsibly with social issues. In addition, potential director candidates are interviewed to assess intangible qualities, including the individual’s ability to engage in constructive deliberations, by asking difficult questions, working collaboratively, and respecting differing views of other Board members. Our Consideration of Diversity Diversity of Board membership is important, because a variety of points of view improves the quality of dialogue, contributes to a more effective decision-making process and enhances overall culture in the boardroom. In evaluating candidates for Board membership, the Board and the Nominating and Corporate Governance Committee consider many factors based on the specific needs of the business and what is in the best interests of the Company’s shareholders. This includes diversity of professional experience, race, ethnicity, gender, age and cultural background. In addition, the Board and the Nominating and Corporate Governance Committee focus on how the experiences and skill sets of each director complement those of fellow directors to create a balanced Board with diverse viewpoints and deep expertise. |

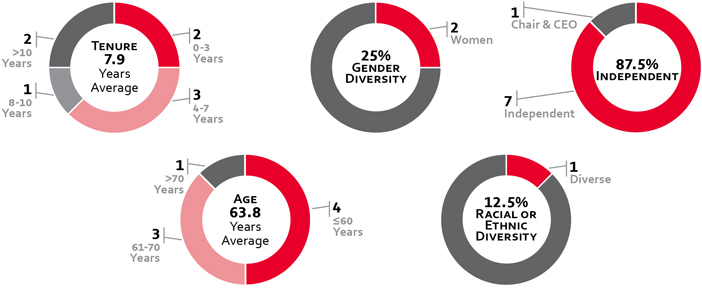

BOARD COMPOSITIONBoard Composition & REFRESHMENTRefreshment

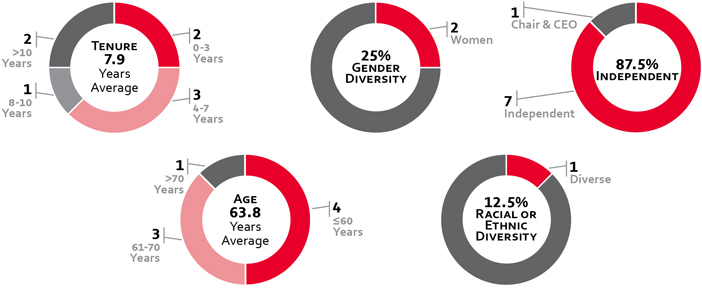

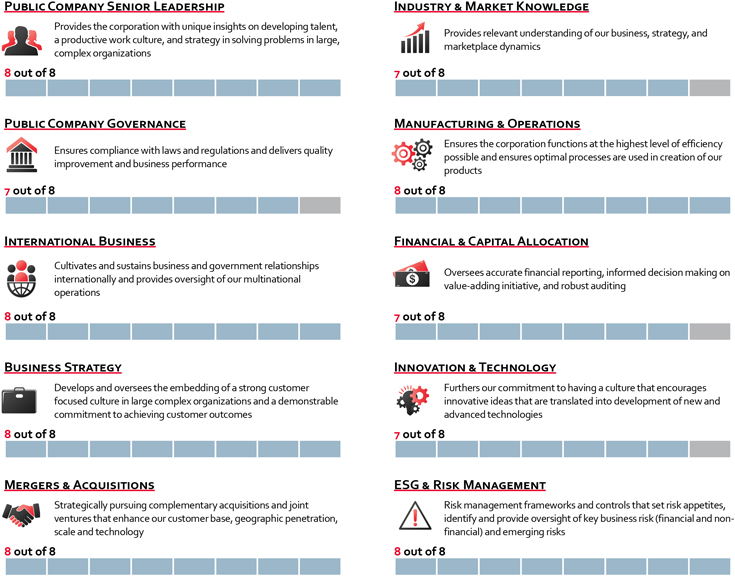

The Board regularly reviews the skills, experience and background that it believes are desirable to be represented on the Board. On an annual basis, the Board reviews each director’s skills and assesses whether there are gaps that need to be filled. As a result, recruitment is an ongoing activity. A snapshot of our directors’ skills, including director nominees, is below, while the full skills matrix can be found under “Board Self-Assessment & Skills Matrix” of this Proxy Statement on page 3422. The Board aims to strike a balance between the experience that comes from long-term service on the Board with the new perspective that new Board members bring, while being sensitive to the benefits of gender and racial diversity. The Board also has a mandatory retirement policy, under which no director may stand for re-election if he or she has reached the age of 75. The election of Ms. Davenport would bring the refreshment to 6 directors, two of which are female and one of which is a racial minority, over the past 8 years. We believe this balanced approach creates a renewed perspective that is beneficial to shareholders. Please refer to “Identifying and Evaluating Candidates for Board Membership” on page 3523for further information. | | | | Snapshot of 2023 Director Nominees and Continuing Directors | 12 | | 2021 PROXY STATEMENT

| | |

Demographics

SNAPSHOTOF 2021 DIRECTOR NOMINEESAND CONTINUING DIRECTORS

DEMOGRAPHICS

SKILLS

| 2023 Director Nominees | | 2021 PROXY STATEMENT | | | 13 | |

2021 DIRECTOR NOMINEES

The following is biographical information for each director nominee and each continuing director. The information includes names, ages, principal occupations for at least the past five years, the year in which each director joined our Board and certain other information. The information is current as of September 10, 2021,8, 2023, except for each director’s age, which is current as ofOctober 26, 2021. CLASS I DIRECTORS - TERM EXPIRING 2024:24, 2023.

| | | | Required Vote & Recommendation | 14 | | 2021 PROXY STATEMENT

| | |

CLASS II DIRECTOR - TERM EXPIRING 2023:

REQUIRED VOTE & RECOMMENDATION

Our By-Laws require that, in an uncontested election, each director be elected by a majority of the votes cast. A majority of votes cast means that the number of votes cast “FOR” a director’s election exceeds the number of votes cast “AGAINST” that director. Shareholders that either mark “ABSTAIN” on the proxy card or otherwise abstain from voting will not be counted as either “FOR” or “AGAINST.” Broker non-votes will not be counted as either “FOR” or “AGAINST.” In the event that there is a contested election, each director will be elected by a plurality of the votes cast, which means the directors receiving the largest number of “FOR” votes will be elected to the open positions.

In the event that any nominee becomes unavailable, the Board may either choose a substitute or postpone filling the vacancy until a qualified candidate is identified. If there is a substitute, the individuals acting under your proxy may vote for the election of a substitute. The nominees have indicated their willingness to serve as directors and we have no reason to believe that any nominee will become unavailable.

The Board of Directors recommends that you vote “FOR” setting the number of directors at eight and “FOR” the election of each nominee.

CONTINUING DIRECTORS

CLASS III DIRECTORS - TERM EXPIRING 2022:

CLASS II DIRECTORS - TERM EXPIRING 2023:

The Compensation Committee recommended, and our Board has approved, subject to shareholder approval, an amendment to and restatement of the 2018 Omnibus Incentive Plan (“OIP”). This amended and restated OIP would increase the number of shares authorized for grants under the OIP by 400,000 to 900,000 shares of our Common Stock. This is the first time we have requested approval to increase the number of shares authorized for issuance under the OIP.

We are also seeking shareholder approval to amend Section 4(a) of the OIP regarding the method of determining the number of shares available for issuance under the OIP. This amended and restated OIP would require that for every share granted under an award under the OIP, the number of total shares available for issuance be reduced by 1.0. Currently, for awards that provide for a range of potential payouts, the OIP requires shares available for issuance be reduced by the maximum number of shares which may be paid under such awards. By amending Section 4(a), we believe this method of determining shares available for issuance is a more accurate reflection of our historic awards and payouts, which have generally been at or below target levels.

Our Board recommends that shareholders approve the amended and restated OIP because it will allow the Company to successfully attract and retain the best possible candidates. We previously believed that the initial 500,000 authorized shares would be sufficient to cover our anticipated needs for a period of 5 years. However, we now believe that the initial authorized shares will be sufficient for anticipated grants during FY 2022, but will likely not be sufficient for grants in FY 2023. For these reasons, the Board recommends that shareholders approve an amended and restated OIP to increase the number of Common Stock authorized for future awards to be granted under the OIP and to amend Section 4(a).

As of June 30, 2021, the number of shares of Common Stock that remained available for future grants was 46,791 using the current method of determining shares available for issuance, or 208,971 using the proposed method of determining shares available for issuance. If this proposal is approved, the combined 608,971 shares available under the OIP would represent approximately 5% of fully diluted Common Stock outstanding as of June 30, 2021. The Board believes that this number of shares represents a reasonable amount of potential equity dilution in light of the purposes of the OIP, as described below. If the amended and restated OIP is approved and we issue awards in amounts consistent with the three-year average burn rate described below, it is anticipated that the available shares will meet our needs for approximately 5 years. Assuming shareholders approve this proposal, we will file a Registration Statement on Form S-8 to register the additional Common Stock available for issuance.

SIGNIFICANT HISTORICAL AWARD INFORMATION

The following table provides information regarding the grant of equity awards over the past three fiscal years. The information accounts for PSU awards at target rather than maximum.

| | | | | | | | | | | | | | Equity Metric | | 2021 | | | 2020 | | | 2019 1 | | | | | | Percentage of equity awards granted to NEOs | | | 52% | | | | 51% | | | | 0% | | | | | | Equity burn rate 2 | | | 1.29% | | | | 0.98% | | | | 0.11% | | | | | | Dilution 3 | | | 3.87% | | | | 5.09% | | | | 5.82% | | | | | | Overhang 4 | | | 2.81% | | | | 2.11% | | | | 1.88% | |

| 1 | FY 2019 grants made prior to the October 23, 2018 adoption of the OIP were made under the 2008 Long Term Incentive Plan. The values contained here include FY 2019 grants made under the OIP only.

|

| 2 | The burn rate is calculated by taking the number of shares granted and dividing that by the weighted average basic Common Stock outstanding. The following table provides information regarding stock-settled, time-vested equity awards granted and performance-based, stock-settled equity awards granted over each of the last 3 fiscal years:

|

| | | | | | | | | | | | | | | | 2021 | | | 2020 | | | 2019 | | | | | | Time-Vested Restricted Shares/Units Granted | | | 72,475 | | | | 75,505 | | | | 16,273 | | | | | | MSPP Shares Granted | | | 19,311 | | | | 14,883 | | | | - | | | | | | Performance-Based Stock Units Granted (at target) | | | 69,071 | | | | 42,976 | | | | - | | | | | | Weighted Average Basic Common Stock Outstanding | | | 12,156,000 | | | | 12,324,000 | | | | 12,574,000 | |

| 3 | The dilution is calculated by taking the sum of (i)votes cast “FOR” a director’s election exceeds the number of shares granted and outstanding under awards at fiscal year end and (ii)votes cast “AGAINST” that director. Shareholders that either mark “ABSTAIN” on the proxy card or otherwise abstain from voting will not be counted as either “FOR” or “AGAINST.” Broker non-votes will not be counted as either “FOR” or “AGAINST.”

In the event that there is a contested election, each director will be elected by a plurality of the votes cast, which means the directors receiving the largest number of shares available“FOR” votes will be elected to the open positions. | In the event that any nominee becomes unavailable, the Board may either choose a substitute or postpone filling the vacancy until a qualified candidate is identified. If there is a substitute, the individuals acting under your proxy may vote for issuance under the OIP at fiscal year end,election of a substitute. The nominees have indicated their willingness to serve as directors and dividingwe have no reason to believe that sum byeither nominee will become unavailable. The Board of Directors recommends that you vote “FOR” the numberelection of outstanding Common Stock at fiscal year end.each nominee. |

Class I Directors - Term Expiring 2024: Class III Directors - Term Expiring 2025:

| | 42023 Proxy Statement13 | The overhang is calculated by taking the number of shares granted and outstanding under awards at fiscal year end and dividing it by the number of outstanding Common Stock at fiscal year end.

|

OIP PLAN SUMMARY

The following is a brief description of the principal features of the OIP. This summary is qualified by reference to the full text of the OIP, which is included, as amended and restated, as Appendix A to this Proxy Statement, starting on page 78.

PURPOSE

The purpose of the OIP is to encourage and enable executives, employees, directors and others (as defined in the OIP) to acquire a proprietary interest in Standex. This enables Standex to:

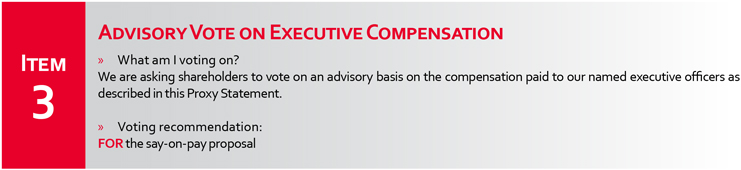

| u | Item 2 | attract and maintain executive, managerial and other key employees;Advisory Vote on Executive Compensation

|

| u | | motivate participants

» What am I voting on?

We are asking shareholders to achieve long-range goals consistent with increases in shareholder value;

|

| u | | provide incentive compensation opportunities that are flexible and competitive with those offered by other businesses;

|

| u | | support the Company’s executive compensation program, as discussed in the Compensation Discussion & Analysis section of this Proxy Statement; and

|

| u | | align the interests of participants with shareholder interests through compensation that is basedvote on an advisory basis on the value of the Company’s common stock.

|

ELIGIBILITY

The OIP authorizes the following types of awards to be made to any employee, officer, non-employee director, or Third Party Service Provider, as defined in the OIP, of the Company and its subsidiaries, as designated by the Compensation Committee. All awards will be evidenced by a written award agreement between the Company and the participant and will include such provisions and conditions as may be specified by the Compensation Committee.

TYPESOF AWARDS

STOCK OPTIONS

Stock options give the holder the right to purchase shares of common stock at a specified price during specified time periods. The exercise price of an option granted under the OIP may not be less than the fair market value of the common stock on the date of grant. Stock options granted under the OIP have a maximum term of 10 years. The OIP authorizes both incentive stock options and nonqualified stock options. Incentive stock options can only be granted to employees of the Company or its subsidiaries and have an annual fair market value limit of $100,000 per recipient. Stock options are not a part of the Company��s current compensation program.

RESTRICTED STOCKAND RESTRICTED STOCK UNITS

Awards of Restricted Stock (“RSAs”) grant the recipient shares of common stock which are subject to certain vesting requirements. Restricted Stock Unit (“RSU”) awards grant the recipient the right to receive a certain number of common stock at vesting, subject to certain vesting requirements. Recipients of such awards do not have any voting rights until the vesting requirements are satisfied, unless the Compensation Committee determines otherwise. Vesting requirements include continued employment, achievement of pre-established goals or a combination of both. The Company currently grants time-based RSAs, which do have voting rights, and also grants RSUs as part of the Management Stock Purchase Plan, which do not have voting rights.

STOCK APPRECIATION RIGHTS

Stock Appreciation Rights (“SARs”) give the holder the right to receive, either in cash or common stock equivalent, the excess of the fair market value of one share of common stock on the date of exercise, over the exercise price of the SAR. The exercise price of the SAR may not be less than the fair market value of the common stock on the date of grant. SARs granted under the OIP have a maximum term of 10 years. SARs are not a part of the Company’s current compensation program.

UNRESTRICTED STOCK AWARDS

The Compensation Committee, in its discretion, may grant or sell to any eligible person shares of common stock free of restrictions. The sales price of such stock awards is determined by the Compensation Committee. The OIP allows the granting or selling of unrestricted stock awards as payment for past services or other valid consideration. Unrestricted stock awards cannot be sold, assigned, transferred, pledged or otherwise encumbered.

PERFORMANCE AWARDS

Performance awards grant the recipient the right to receive, either in cash or shares of common stock, a payout upon the attainment of pre-established performance goals. The Company’s current compensation program includes performance share unit awards, as a component of long-term equity incentive compensation, and performance cash awards, as annual short-term incentive compensation.

SHARES

MAXIMUM NUMBEROF SHARES AVAILABLE

With the amendment, the maximum number of shares of Company common stock which may be allocated to awards, including SARs, is 900,000 shares.

SHARE POOLAND SHARE COUNTING

With the amendment, each share issued pursuant to an award under the OIP will reduce the number of shares available by one share. Shares subject to awards under the OIP that terminate or expire unexercised, or are canceled, terminated, forfeited or lapse for any reason, or are exchanged for an award that does not involve the issuance of shares and shares underlying awards that are ultimately settled in cash, will become available for future grants of awards under the OIP. Similarly, in the event that a maximum payout is not reached, the unearned shares originally subject to the award will be added back to the share reserve. The following shares do not return to the share pool and are not available for issuance under the OIP: (i) shares used to pay the exercise price or withholding taxes related to an outstanding stock option or SAR; (ii) shares that are not issued or delivered upon the exercise of an SAR; and (iii) shares repurchased by the Company on the open market with proceeds from the exercise of a stock option.

EXPECTED DURATIONOFTHE SHARE RESERVE

If this proposal is approved by our shareholders, we expect that the share reserve under the OIP will be sufficient for awards for approximately 5 years. Expectations regarding future share usage could be impacted by a number of factors such as award type mix; hiring and promotion activity at the executive level; the rate at which shares are returned to the OIP’s share pool upon expiration, forfeiture or cash settlement; the future performance of our stock price; the consequences of acquiring other companies; and other factors. While we believe that the assumptions are reasonable, future share usage may differ from current expectations.

ADJUSTMENTSTO SHARE RESERVE

The number of shares allocated to the OIP shall be appropriately adjusted to reflect any subsequent equity restructuring, such as stock dividends, stock splits, reverse stock splits and similar matters affecting the overall number of the Company’s outstanding shares. Similarly, in the event of any other change in corporate capitalization, the Compensation Committee has the authority to make equitable adjustments to prevent dilution or enlargement of any rights granted under the OIP.

ADMINISTRATION

The OIP is administered by the Compensation Committee. The Compensation Committee has the authority to:

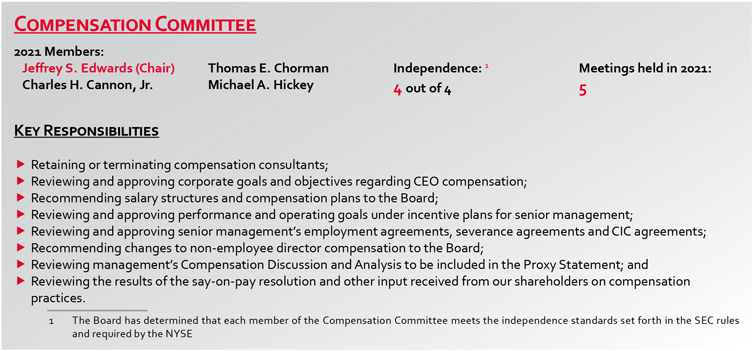

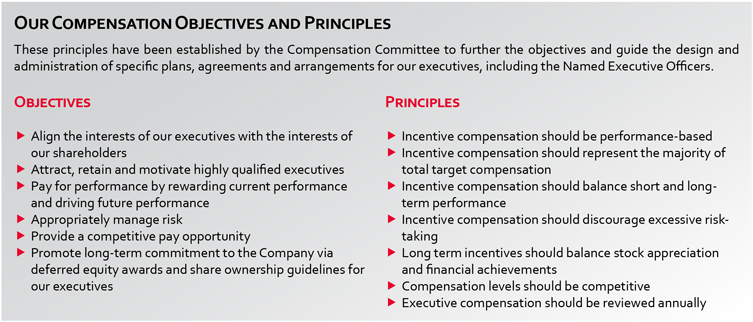

| u | | determine the type or types of awardscompensation paid to be granted to each participant and the amount, terms and conditions thereof;

|

| u | | establish, adopt or revise any rules, regulations, guidelines and procedures as it may deem advisable to carry out the provisions and purposes and administer the OIP; and

|

| u | | prescribe forms of award agreements, and make rules, interpretations and any and all other decisions and determinations that may be required under the OIP.

|

Additionally, the Compensation Committee may, by resolution, authorize any officer of the Company to designate employees as award recipients and determine the amount of such awards. This delegation is limited by: (i) not allowing the authorized officer to grant an award to an officer (defined as a reporting person under Section 16 of the Exchange Act); (ii) requiring the resolution to include the total number and/or dollar value of awards the officer is allowed to grant; and (iii) requiring the officer to periodically report to the Compensation Committee regarding the nature and scope of awards granted by the officer. Lastly, the Compensation Committee may expressly delegate to one or more of its members or to one or more officers of the Company or its affiliates or to one or more agents or advisors its administrative duties or powers under the OIP.

TREATMENTOF AWARDSUPON CERTAIN EVENTS

TERMINATIONOF CONTINUOUS SERVICE

The applicable award agreement or special plan document governing an award will specify the treatment of such award upon the termination of a participant’s continuous service. Continuous service means the absence of any interruption or termination of service as an employee, officer or director; provided that the following will not be considered an interruption in service: (i) a participant transfers employment, without interruption, between the Company and an affiliate or between affiliates, (ii) in the case of a spin-off, sale or disposition transaction where the Compensation Committee determines that no interruption will result or (iii) the participant is granted an unpaid leave of absence authorized in writing by the Company that does not exceed 12 months. The OIP defines an affiliate as any parent company of Company and each subsidiary of the Company, as those terms are defined in Section 424 of the IRC.

CHANGEIN CONTROL

Unless otherwise provided in an award agreement or any special plan document or separate agreement with a participant governing an award, upon the occurrence of a change in control (“CIC”) of the Company in which awards are not assumed by the surviving entity or otherwise converted into a Replacement Award, as defined in the OIP, the following shall occur:

| u | | A participant’s then-outstanding stock options and SARs that are not vested and are only subject to continuous service shall immediately become fully vested and exercisable over the exercise period set forth in the applicable award agreement. The Compensation Committee may elect to cancel such awards and pay a cash amount, unless the exercise price exceeds the value of the consideration received by the participant as a result of the CIC.

|

| u | | All other awards subject to continuous service shall become fully vested.

|

| u | | A participant’s then-outstanding stock options and SARs that are not vested and are subject to attaining certain performance measures shall immediately become vested and exercisable as of the date of the CIC. Where performance measures provide for a range of payouts, the number of shares that shall vest is based on the higher of (i) actual performance through the date of the CIC, or (ii) target performance. No payment shall be made if the exercise price exceeds the value of the consideration received by the participant as a result of the CIC.

|

| u | | All other awards subject to attaining certain performance measures shall immediately vest and be settled based on the higher of (i) actual performance through the date of the CIC, or (ii) target performance.

|

Unless otherwise provided in an award agreement or any special plan document or separate agreement with a participant governing an award, if there is a change in control of the Company and a qualifying Replacement Award is provided to the participant, the participant shall not receive any automatic vesting or acceleration of the Replaced Award, as defined in the OIP. However, if a participant’s employment is involuntarily terminated other than for cause after such a change in control, then a participant’s Replacement Award in the form of:

| u | | stock options or SARs shall become fully exercisable;

|

| u | | performance-based awards shall be deemed to be fully satisfied at the target level and be paid within 60 days of the termination; and

|

| u | | service-based awards shall become fully vested and paid within 60 days of the termination.

|

FORFEITURE EVENTS

Awards under the OIP will be subject to any compensation recoupment policy that the Company may adopt from time to time that is applicable to the participant, including the claw back policy. An award agreement may specify that an award will be reduced, canceled, forfeited or recouped upon certain events, including (i) termination of employment for cause; (ii) violation of material Company policies; (iii) breach of noncompetition, confidentiality or other restrictive covenants that may apply to the participant; (iv) other conduct by the participant that is detrimental to the business or reputation of the Company; and (v) a later determination that the vesting of, or amount realized from, a performance award was based on materially inaccurate financial statements or performance metric criteria, whether or not the participant caused or contributed to such inaccuracy. The Company will also seek to recover any granted awards as required by the provisions of the Dodd-Frank Wall Street Reform and Consumer Protection Act or any other law or listing standards of the NYSE.

TERMINATION & AMENDMENT

The OIP became effective on October 23, 2018 and shall continue until October 23, 2028 unless earlier terminated by the Board or the Compensation Committee. The Board or the Compensation Committee may, at any time and from time to time, amend, modify or terminate the OIP, unless such an amendment or modification would require shareholder approval under applicable laws, regulations or the NYSE rules.

The Compensation Committee may amend, modify or terminate an outstanding award without the approval of the participant, provided however, (i) the value of such award may not be reduced or diminished without the participant’s consent; (ii) the original term of an option or SAR may not be extended without prior approval of the Company’s shareholders; (iii) subject to the anti-dilution provisions of the OIP, the exercise price of an option or base price of an SAR may not be reduced, directly or indirectly (such as an exchange of an “underwater” option or SAR for cash or for another award), without the prior approval of the Company’s shareholders; and (iv) no termination, amendment or modification of the OIP will adversely affect any award previously made under the OIP without the consent of the affected participant.

TAX CONSEQUENCESOF AWARDS

The following discussion is limited to a summary of the U.S. federal income tax provisions relating to the making, exercising and vesting of awards under the OIP and the subsequent sale of common stock acquired under the OIP. The tax consequences of awards may vary depending upon the particular circumstances, and it should be noted that the income tax laws, regulations and interpretations thereof change frequently. Participants should rely upon their own tax advisors for advice concerning the specific tax consequences applicable to them, including the applicability and effect of state, local and foreign tax laws.

NONSTATUTORY STOCK OPTIONS

There will be no federal income tax consequences to the optionee or to the Company upon the grant of a stock option under the OIP. When the optionee exercises a stock option, however, they will recognize ordinary income in an amount equal to the excess of the fair market value of the common stock received upon exercise over the exercise price, and the Company expects that it will be allowed a corresponding deduction. Any gain that the optionee realizes when the optionee later sells or disposes of the option shares will be short-term or long-term capital gain, depending on how long the shares were held.

STOCK APPRECIATION RIGHTS

At the time the award is granted, a participant receiving a SAR will not recognize income, and the Company will not be allowed a tax deduction. When the participant exercises the SAR, the amount of cash and the fair market value of any shares of common stock received will be ordinary income to the participant and the Company expects that it will be allowed a corresponding income tax deduction at that time.

RESTRICTED STOCK

Generally, the participant will not recognize income and the Company will not be allowed a tax deduction, at the time a restricted stock award is granted, provided that the award is subject to restrictions on transfer and is subject to a substantial risk of forfeiture. When the restrictions lapse, the participant will recognize ordinary income equal to the fair market value of the common stock as of that date (less any amount paid for the stock), and the Company will be allowed a corresponding income tax deduction at that time, subject to any applicable limitations under IRC Section 162(m). If the participant files an election under IRC Section 83(b) within 30 days after the date of grant of the restricted stock, they will recognize ordinary income as of the date of grant equal to the fair market value of the stock on that date (less any amount paid for the stock), and the Company will be allowed a corresponding income tax deduction at that time, subject to applicable IRC Section 162(m) limitations. Any future appreciation in the stock will be taxable to the participant at capital gains rates. However, if the stock is later forfeited, the participant will not be able to recover the tax previously paid pursuant to the election. To the extent unrestricted dividends are paid during the restricted period under the applicable award agreement, any such dividends will be taxable to the participant as ordinary income and will be deductible by the Company unless the participant has made an election under IRC Section 83(b), in which case the dividends will thereafter be taxable to the participant as dividends and will not be deductible by the Company.

STOCK UNITS

A participant will not recognize income, and the Company will not be allowed a tax deduction, at the time a stock unit award is granted. Stock unit awards are typically RSUs or PSUs. Upon receipt of shares of common stock (or the equivalent value in cash) in settlement of a stock unit award, a participant will recognize ordinary income equal to the fair market value of the common stock or other property as of that date, and the Company will be allowed a corresponding income tax deduction at that time, subject to any applicable limitations under IRC Section 162(m).

CASH-BASED AWARDS

A participant will not recognize income at the time a cash-based award is granted (for example, when the performance goals are established). Upon receipt of cash in settlement of the award, a participant will recognize ordinary income equal to the cash received. The Company will be allowed a corresponding income tax deduction at the time the award is accrued under GAAP, as long as the award is settled within 2 1/2 months of the end of the fiscal year and subject to any applicable limitations under IRC Section 162(m). Otherwise, the Company will be allowed a corresponding income tax deduction at the time the award is paid.

IRC SECTION 409A

If an award is subject to IRC Section 409A (which relates to nonqualified deferred compensation plans), and if the requirements of Section 409A are not met, the taxable events as described above could apply earlier than described, and could result in the imposition of additional taxes and penalties. All awards that comply with the terms of the OIP, however, are intended to be exempt from the application of Section 409A or meet the requirements of Section 409A in order to avoid such early taxation and penalties.

TAX WITHHOLDING

The Company has the right to deduct or withhold, or require a participant to remit to the Company, an amount sufficient to satisfy the Company’s federal, state and local tax withholding obligations (including employment taxes) imposed by law with respect to any exercise, lapse of restriction or other taxable event arising as a result of an award under the OIP. The Compensation Committee may, at the time the award is granted or thereafter, require or permit that any such withholding requirement be satisfied, in whole or in part, by delivery of, or withholding from the award, shares having a fair market value on the date of withholding equal to the amount required to be withheld for tax purposes.

BENEFITSTO NAMED EXECUTIVE OFFICERS & OTHERS

Because awards under the OIP are discretionary, benefits or amounts that may be received by or allocated to eligible participants are not presently determinable. No awards that are contingent upon obtaining shareholder approval of the amendment of the OIP have been made.

The following table shows all of the awards under the OIP for FY 2021:

| | | | | Name and Position | | Number of Shares of Common

Stock Covered by Awards 1 | | | | David Dunbar, Chair, President & CEO

| | | 50,260 | | | | Ademir Sarcevic, Vice President, CFO & Treasurer

| | | 13,487 | | | | Alan J. Glass, Vice President, CLO & Secretary

| | | 8,755 | | | | Paul C. Burns, Vice President of Business Development & Strategy

| | | 7,460 | | | | James Hooven, Vice President of Operations & Supply Chain

| | | 3,218 | | | | All currentour named executive officers as a group

| | | 91,844 | | | | All current non-employee directors as a group

| | | 14,781 | | | | All employees as a group (excluding current executive officers)

| | | 54,232 | |

| 1 | The awards includeddescribed in this column are RSAs and PSUs (at target) made underProxy Statement.

» Voting recommendation:

FOR the OIP during FY 2021, and RSUs awarded pursuant to an MSPP deferral during FY 2021.say-on-pay proposal

|

REQUIRED VOTE & RECOMMENDATION

Approval of this proposal will require the affirmative vote of a majority of the votes cast in person or represented by proxy. Abstentions will not count as votes cast on this proposal, so abstentions will have no effect on the outcome. Broker non-votes will not be considered to have voted on this proposal, so will have no effect on the outcome.

The Board recommends that you vote “FOR” the amendment to and restatement of the 2018 Standex Omnibus Incentive Plan.

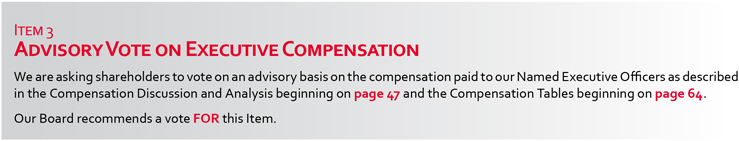

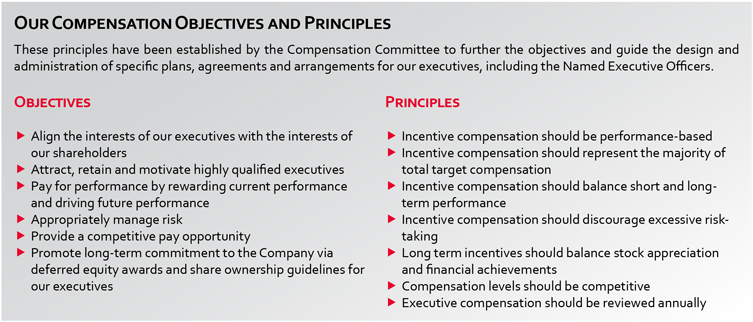

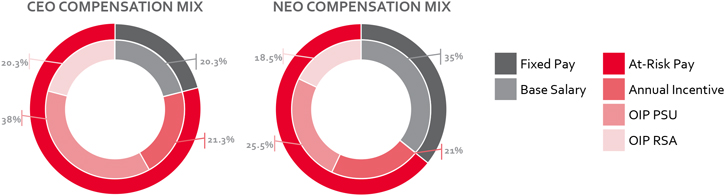

At each annual meeting, the Board provides shareholders with the opportunity to cast an advisory vote to approve the compensation of our named executive officers. Please see the “Summary Compensation Table” starting on page 6454for full details. This proposal, commonly known as a “Say on Pay” proposal, gives our shareholders the opportunity to endorse or not endorse our executive compensation programs and policies and the total compensation paid to our named executive officers. This advisory vote does not address any specific element of compensation, but rather the overall compensation of our named executive officers and our compensation philosophy, policies and practices, as detailed in the “Compensation Discussion & Analysis” starting on page 4736. Although this vote is non-binding, the Board values the opinions of the Company’s shareholders and will consider the outcome of the vote when making future compensation decisions for our named executive officers. As described in more detail in the Compensation Discussion and Analysis (“CD&A”) section, we have designed our executive compensation programs to align the long-term interests of our executives with those of our shareholders, attract and retain talented individuals and reward current performance. A large portion of the compensation is tied to the Company’s performance and is paid in both performance and time-based equity. This closely aligns both the short-term and long-term interests of our executives with those of shareholders and drives the creation of shareholder value. We encourage shareholders to review the CD&A, which describes our philosophy and business strategy underpinning the programs, the individual elements of the compensation programs and how our compensation plans are administered. REQUIRED VOTE & RECOMMENDATION

| Required Vote & Recommendation |

Approval of this advisory proposal will require the affirmative vote of a majority of the votes cast in person or represented by proxy. Abstentions will not count as votes cast on this proposal, so abstentions will have no effect on the outcome. Broker non-votesnon- votes will not be considered to have voted on this proposal, so will have no effect on the outcome. The advisory vote on executive compensation is non-binding, therefore, our Board will not be obligated to take any compensation actions or adjust our executive compensation programs or policies as a result of the vote. Notwithstanding, the resolution will be considered passed with the affirmative vote of the majority of the votes cast at the Annual Meeting. The Board recommends that you vote “FOR” the following non-binding resolution: RESOLVED, that the compensation of the Company’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and narrative discussion, is hereby APPROVED. Item 3 | | | | | 2021 PROXY STATEMENTRatification of Independent Auditors

| | | 25 | |

Every six years, as required by the Dodd-Frank Wall Street Reform and Consumer Protection Act, the Board provides shareholders with the opportunity to cast an advisory vote on the frequency of the advisory vote to approve our executive compensation. This year, we are seeking a non-binding determination from our shareholders as to how often the “Say on Pay” advisory vote should be held. Shareholders have the following frequency options to choose from: each year, every two years or every three years.

When this advisory vote was last held in 2015, shareholders indicated a preference to hold the advisory vote on executive compensation each year and the Board continued this practice.

The Board continues to believe that an annual advisory Say on Pay vote is the most appropriate policy for our shareholders and the Company at this time. An annual advisory vote allows the Board to receive timely, ongoing feedback from our shareholders. This assists the Board in taking shareholder views into account when considering changes to the executive compensation program. Additionally, an annual advisory vote is currently the standard desired by many shareholders.

Although this vote is non-binding, the Board values the opinions of the Company’s shareholders and will consider the outcome of the vote when making future decisions on the frequency of our Say on Pay proposals.

REQUIRED VOTE & RECOMMENDATION

While the Board recommends an annual advisory vote on executive compensation, shareholders may vote to hold the advisory vote on executive compensation each year, every two years or every three years.

Abstentions will not count as votes cast on this proposal, so abstentions will have no effect on the outcome. Broker non-votes will not be considered to have voted on this proposal, so will have no effect on the outcome.

The advisory vote on the frequency of holding the advisory vote on executive compensation is non-binding, therefore, our Board will not be obligated to take any actions or change the frequency as a result of the vote.

The Board recommends that you vote “FOR” holding the advisory vote on the compensation paid to our named executive officers with a frequency of “ONE YEAR”.

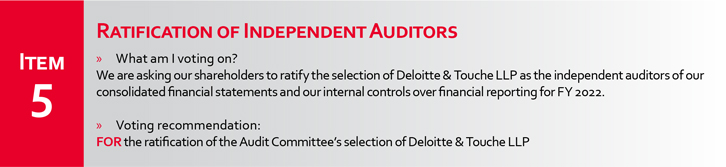

» What am I voting on?

We are asking our shareholders to ratify the selection of Deloitte & Touche LLP as the independent auditors of our consolidated financial statements and our internal controls over financial reporting for FY 2024.

» Voting recommendation:

FOR the ratification of the Audit Committee’s selection of Deloitte & Touche LLP

The Audit Committee has approved Deloitte & Touche LLP (“Deloitte”) to serve as our independent registered public accounting firmauditors for the 20222024 fiscal year. Deloitte was appointed on August 26, 2020. The Company did not engage Deloitte at any time during the two years before the appointment for any accounting-related matter. In the time since Deloitte’s appointment, Deloitte’s reports on the Company’s financial statements did not contain any adverse opinion or a disclaimer of opinion, nor was Deloitte’s opinion qualified or modified as to uncertainty, audit scope or accounting principles. Grant Thornton LLP (“Grant Thornton”) had served as the Company’s independent auditors from 2014 until their replacement on August 26, 2020 as the result of a competitive process. During that time, there were no disagreements between the Company and Grant Thornton on any matter of accounting principles or practices, financial statement disclosures or auditing scope or procedure. Also, during that time, Grant Thornton’s report on the Company’s financial statements did not contain any adverse opinion or a disclaimer of opinion, nor was it qualified or modified as to uncertainty, audit scope or accounting principles.

We are asking our shareholders to ratify the appointment of Deloitte as our independent registered public accounting firm.auditors. Although shareholder ratification is not required, the Board is submitting the proposal because we value our shareholders’ views on the Company’s independent auditorauditors and as a matter of good corporate practice. In the event that our shareholders fail to ratify the appointment, the Audit Committee will investigate the reasons and consider selecting a different firm. Even if the selection is ratified, the Audit Committee may select a different independent auditorauditors at any time during the year if it determines such a change would be in the best interests of the Company and its shareholders. A representative from Deloitte will be available at the Annual Meeting to, as requested, make a statement, speak with shareholders or respond to appropriate questions. PRE-APPROVAL POLICY

All services performed in FY 20212023 were pre-approved by the Audit Committee in accordance with the Audit Committee’s charter. The pre-approval policy requires the independent auditorauditors to submit an itemization of the services to be provided and fees to be incurred during the fiscal year. The Audit Committee approves the scope and timing of the external audit plan and focuses on any matters that may affect the scope of the audit or the independence of the independent auditor. In that regard, the Audit Committee receives certain representations from the independent auditorauditors regarding its independence and the permissibility, under the applicable laws and regulations, of any services provided. Once the initial audit plan has been approved, any requests for additional services or fees must be submitted to the Audit Committee for approval. These additional services may not commence until the Audit Committee reviews and approves the request. These requests for approval are normally evaluated during regularly scheduled Audit Committee meetings. However, if a request is submitted between meeting times, the Chair of the Audit Committee may approve the request pursuant to a delegation of authority. For the Chair of the Audit Committee, the approval authority is limited to services valued at less than $100,000. Any requests for services exceeding $100,000 must be approved by the full Audit Committee. If the Chair has exercised their approval authority, they must disclose all approval determinations to the full Audit Committee at the next regularly scheduled meeting. | | | | | | Relationship with Independent Registered Public Accounting Firm | | | | | | | 2021 PROXY STATEMENT | | | 27 | |

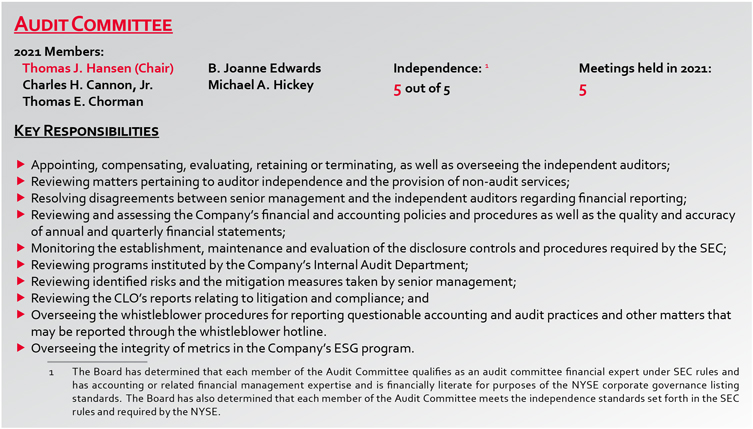

RELATIONSHIPWITH INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee reviews all relationships between the independent auditor and the Company, including the provision of non-audit services. Deloitte has provided limited non-audit services during FY 2021to the Company related to tax compliance, and tax advisory and transaction due diligence services. The Audit Committee considered the effect of Deloitte’s non-audit services in assessing its independence. After discussion with Company management and Deloitte, the Audit Committee concluded that the provision of these services was permitted under the rules and regulations concerning auditor independence. INDEPENDENT AUDITOR’S FEES

Independent Auditor’s Fees |

The following table summarizes the aggregate fees for audit and non-audit services incurred by the Company. The Audit Committee pre-approved all of these audit and non-audit fees in accordance with the pre-approval policy described above. The fees for FY 2020 shown below were for Grant Thornton’s services, while the fees for FY 2021 were for Deloitte’s services. | Type of Fees | | | 2020 ($)* | | | | 2021 ($)* | | | Description | | FY 2022 ($)* | | | FY 2023 ($)* | | Description | | | | | | | | Fees for audit services performed during fiscal year 2020 consisted substantially of: auditing the Company’s annual financial statements, reviewing the Company’s quarterly financial statements, audit services in connection with the adoption of ASC 842 and audit services in connection with acquisitions and divestitures. | | | Audit Fees | | | 1,563,000 | | | | 1,371,000 | | | Fees for audit services performed during fiscal year 2021 relate to professional services rendered in connection with the annual audit of our consolidated financial statements and internal control over financial reporting; the reviews of the condensed consolidated financial statements performed in connection with each of our Quarterly Reports on Form 10-Q; and statutory audits required by foreign jurisdictions. | | 1,422,000 | | | 1,542,000 | | Fees for audit services performed during FY 2022 and FY 2023 relate to professional services rendered in connection with the annual audit of our consolidated financial statements and internal control over financial reporting; the reviews of the condensed consolidated financial statements performed in connection with each of our Quarterly Reports on Form 10-Q; and statutory audits required by foreign jurisdictions. | | Audit-Related Fees | | | 239,000 | | | | - | | | Fees for audit-related services performed during fiscal year 2020 consisted substantially of international statutory audit-related services in Germany, India, Ireland, Malaysia, Mexico, Portugal and the United Kingdom. | | - | | | 15,000 | | Fees for audit-related services in FY 2023 were for review of an SEC Comment Letter. | | | | | | | | Fees for tax services performed during fiscal year 2020 consisted substantially of tax assistance in Malaysia, Mexico, the Netherlands and Turkey. | | | Tax Fees | | | 21,000 | | | | 94,000 | | | For FY 2021, tax fees consist of fees billed for permissible professional services performed by Deloitte Tax LLP, an affiliate of Deloitte, for tax compliance, planning and advice. | | 34,000 | | | 28,000 | | Fees for tax services during FY 2022 and FY 2023 consisted of fees billed for permissible professional services performed by Deloitte Tax LLP and its global member firm affiliates, an affiliate of Deloitte, for tax compliance, planning and advice. | | All Other Fees | | | 1,000 | | | | - | | | Fees for all other services in 2020 represent agreed upon procedures performed by Grant Thornton in Ireland in connection with a government grant. | | 113,000 | | | 2,000 | | All other fees for FY 2022 related to transaction diligence services. All other fees for FY 2023 are for a subscription to an accounting research tool used for accounting and financial disclosures. | | Total Fees | | | 1,824,000 | | | | 1,465,000 | | | | | 1,569,000 | | | | 1,587,000 | | |

| | * | Amounts have been rounded to the nearest thousand.

| Amounts have been rounded to the nearest thousand. |

REQUIRED VOTE & RECOMMENDATION

| Required Vote & Recommendation |

Approval of this advisory proposal will require the affirmative vote of a majority of the votes cast in person or represented by proxy. Abstentions will not count as votes cast on this proposal, so abstentions will have no effect on the outcome. Broker non-votesnon- votes will be considered as a vote “FOR” this proposal. The Board recommends that you vote “FOR” the ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firmauditors for the 20222024 fiscal year. | | | | | 28162023 Proxy Statement | | 2021 PROXY STATEMENT

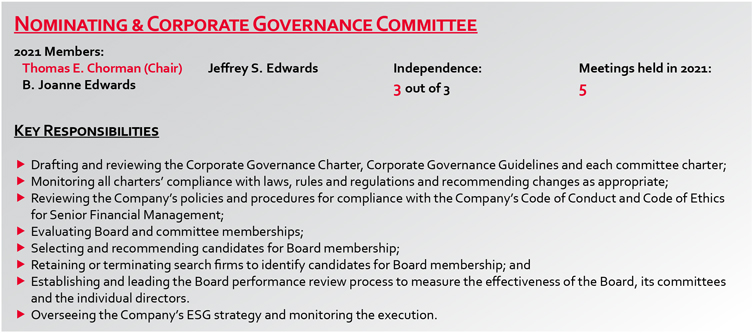

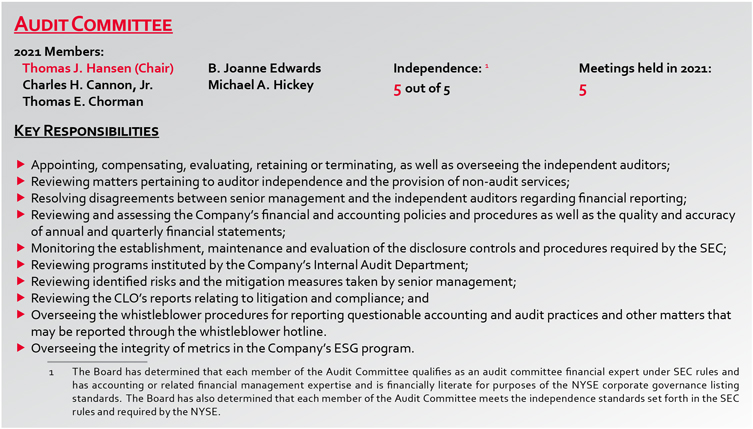

| | |